M3M projects in Gurgaon || All M3M Properties

- By Admin

- General

- 27/05/2021

M3M Group stands for Magnificence in the trinity of Men, Materials & Money. M3M India Pvt Ltd is one of the most prestigious names in the Indian real estate industry. The company started in 1985 and now turned into a well-known reputed brand of real estate world. So far, they have delivered some remarkable M3M projects in Gurgaon, and India. Besides this, they are also active in other social causes together with participating in charity works.

Working with full potential and zeal for the past 2 decades, they have named many times for several awards and recognitions. A M3M India Pvt. Ltd. is not only no. 1 real estate developer of North India but also, holds 2nd position in India. Moreover, they have contributed a lot to the real estate market of Gurgaon and Delhi NCR that their constructions can be seen everywhere in NCR.

Together with the motto of "quality, timely delivery, and excellence", this company is dedicated to providing excellent services to their clients with loyalty. Also, they strictly follow their motto and, deliver world-class luxurious projects on given deadline with outstanding quality standards as well.

So far, M3M set a landmark by building 18 top-quality residential and 16 profitable commercial properties. In addition to this, they also have experience in constructing educational, entertainment, and hospitality projects also. They have more than 4 crore sq. ft. developed and underdeveloped land.

Let's move further and discuss some beautiful residential and commercial M3M projects in Gurgaon one by one:

1. M3M Corner Walk - Sector 74, Gurgaon

.png)

M3M Corner Walk is yet another amazing commercial project developed by M3M developers. The project is launched in Sector 74, Southern Peripheral Road, which is commonly known as the corner location of Golf Course Extension Road, Gurgaon. Additionally, this location provides easy connectivity to Dwarka, Manesar, and Delhi NCR.

In a word, the project is a perfect example of modern architecture and provides a luxury retail zone, exotic food complex, modern office spaces, and also a luxurious residential tower. The whole M3M Corner Walk project is spread across a wide area of 7. 5 acres of land with 350 units available for sale.

Thus, this property provides all up-to-date facilities everyone can wish for. Also, the 12-meter wide boulevard provides a rich dining and shopping experience. Moreover, even for investment, this is the most lucrative property in Gurgaon as the M3M Corner Walk price starts from a minimum of 50 lacs onwards with 50-50 payment plans.

Highlights of M3M Corner Walk:

- High street shopping zone

- With, trendy offices

- Food court with branded outlets

- Beautiful architectural views

- Double heightened shops for sale

- Different entry and exit point for office and retail complex

- 100% power backup

- All-time wifi facility

- 24 x 7 security and CCTV facility

- High-speed elevators and escalators

- Fire safety and a well managed central AC

- Multilevel parking space

2. M3M Icon Merlin - Residential Projects in Sector 67 Gurgaon

![]()

M3M Icon Merlin is another luxury residential project by M3M Group where you can live the life of your dreams, the marvel is placed in sector 67, Golf Course Extension Road, Gurgaon. Meanwhile, the location is a leading location of Gurgaon, as it has many schools, hospitals, and other necessary places nearby.

Especially, the project features stunning Singaporean-style architecture with a blissful view of lush greenery. M3M Icon Merlin is a place where you can enjoy the elegant and classy living style together with modern facilities.

In addition to this, the whole M3M Icon Merlin project is spread across 13.34 acres of land and provides spacious 3 BHK apartments of size 2400 sq. ft with the pricing starts from 1 Cr onwards. On the whole, the project has 11 impartial towers each of which is 30 floors high with 122 units available for sale.

Highlights of M3M Icon Merlin:

- 11 towers with G+30 floors

- 122, 3 BHK units

- Each apartment is 3 side open

- Also, Beautiful park facing apartments

- Multipurpose hall

- Together with, a clubhouse and meditation center

- Gym and other sports facilities

- Fine dining restaurants

- Wide sector roads

- Around schools and hospitals

- Power backup and

- finally, a covered parking area

3. M3M Broadway

M3M Broadway is one of the best commercial projects in Gurgaon, by M3M India that has an international appeal. The project stands apart from busy city sites in Sector 71, Sothern peripheral road, Gurgaon and has grand boulevards, high- Street, beautiful views which make this project perfect by all means. This area is well connected to Sohna Road and other cities.

The M3M Broadway offers flawlessly built commercial and retail shops, F&B stores, office spaces as well as studio apartments. Â Also, the project has 7.85 acres of built-up area in total with 22 floors in one single tower. At the same time, a total of 1488 units is available out of which 600 units are of commercial and retail shops for sale and the rest are the studio apartments, multiplex, and office spaces.

The saleable area presented at M3M Broadway varies from 300 sq. ft. to 4000 sq. ft. with a minimum investment price starting from 70 lacs onwards.

Property Highlights:

- Two-sided access

- Commercial shops, Studio Apartments

- Food court and a multiplex

- Fun and Gaming Zone

- and, 24 x 7 security

- Concierge Services

- Fire safety

- High-speed Escalators and elevators

- 100% power backup

- Car parking

- Leisure activities

- Indoor games area

- Business hall

4. M3M 65th Avenue - Commercial Projects in Sector 65, Gurgaon

Coming next is M3M 65th Avenue, coupled with modern amenities, it is an exceptional mixed-used project introduced by M3M India. Also, the project is well located in the middle of sector 65, Golf Course Extension Road, Gurgaon. This property gives a feel of international projects and provides all modern-day services also.

The total land area covered by M3M 65th Avenue is 14.41 acres with 800 fabulous units available for sale. Investment starts from 50 lacs onwards whereas the minimum saleable area is 300 sq. ft. that provides a great opportunity for investors to invest in a hi-street retail hub, hi-tech office spaces, the entertainment zone, and food court as well as residential apartments.

Above all, M3M 65th Avenue presents the futuristic retail shopping hub with all international and national brands first time a same place. Also an adventure zone comprising various trilled indoor and outdoor activities.

M3M 65th Avenue Highlights:

- Triple height shops

- 8 screen multiplex

- Entertainment zone for family

- Different play zone for kids

- Multiple access points

- Outdoor adventures

- Comfortable escalators and elevators

- Multiple connecting bridges for easy movement

- Food court and restaurants

- Branded retail shops for shopping

- Pubs and dining area

- Also, the sitting arrangement at various places

- 24 x 7Â power backup and wifi facility

- Huge parking space

- Fire detection alarm and sensors with water sprinklers

5. M3M Sky Lofts

M3M Sky Lofts is another lavish residential project in Gurgaon by M3M developers. This property is coupled with a luxurious design and has all the modern-day amenities and local benefits. In short, M3M Sky Lofts is such a project that is perfect in all aspects for a comfortable living.

Located in the light of sector 71, Gurgaon, M3M Sky Lofts offers a segment of magnificence residential apartments/flats, service apartments, and studio apartments in Gurgaon with beautiful interior and architectural designs. This wonder is stretched over 7.85 acres of land and has 1 BHK, 2 BHK, and 3 BHK properties to offer for investment.

The Price of M3M Sky loft apartments is starting from 80 Lacs onwards and together with this 50-50 payment plan option is also available to ease investment. The apartment size is ranging between 683 sq. ft. to 1473 sq. ft. with 15,345 Basic Sale Price.

Features of M3M Sky Lofts:

- Provide 5-star hospitality

- 243 units for sale

- All loft apartments are double heightened

- High-speed elevators

- Restaurants and café

- Swimming pool, Gym

- Children Play area

- 2 level wide parking

- Bowling & Gaming Zone

- 10 multiplex

- Retail shops

- Also, 24 x 7 security and CCTV surveillance facility

- Connected to all nearby locations

- Lawn terrace & pool terrace

- Spa & Health Club

- Golf Course

6. M3M SCO Plots 84

After gaining many names and fame by all means, and introducing a plethora of residential and commercial M3M projects in Gurgaon and Delhi NCR; M3M India Pvt Ltd has come with another product in Gurgaon real estate market, the all-purpose SCO plots.

In short, SCO's are Shops cum Office spaces, which can be used by owners according to their own need. M3M SCO Plots 84 is such a beautiful landmark project by M3M Group. This project is located in the prime site of Sector 84, Dwarka Expressway, Gurgaon. The minimum investment starts with 2 Crore onwards.

Also, M3M SCO Plots brings a unique mixture of commercial plots where high street luxury retail shops and hi-tech office spaces are being offered. The total project land is spread across 8 acres whereas the salable area ranges between 60 sq. yd. to 400 sq. yd. Total 100+ units are available for sale in this place with all the basic yet modern facilities and availabilities.

M3M SCO Plots, Sector 84 brings:

- Total 105 plots for sale

- All plots for sale are of flexible size

- G+4 with basement

- Shopping center

- Always available Property staff

- ATM

- Power backup

- AC units and Lifts can be installed if needed

- Nearby, Highly dense residential societies

- Surface car parking facility

- Â Daycare center

- Electric range

- Rainwater harvesting

- Internet facility

7. M3M Skywalk

In addition to the above, another project of M3M Group in Gurgaon is M3M Skywalk. It is a beautiful milestone residential project. If you are looking for your dream home in sector 74, Gurgaon. Then, this is a must-consider project as it is situated on 150 meters wide golf course extension road, Sector 74 Gurgaon.

Another key point of M3M Skywalk is that it is a perfect blend of the traditional charm of Indian homes with a touch of modern architecture and facilities. Also, M3M Skywalk offers beautiful 2BHK and 3BHK apartments. There is a total of 360 units are available for investment. The general configuration of these units is between 1400 sq ft. to 2000 sq. ft.

Furthermore, M3M Skywalk is itself a great landmark but being a residential part of famous M3M Corner Walk adds a huge value to the success of this project. This project brings great investment opportunities for all investors.

M3M Skywalk highlights:

- Spacious 2BHK and 3BHK apartments

- Next to M3M Corner Walk

- Proximity to every comfortable location of Gurgaon

- Introduce the idea of Walk to work

- Also, a modern home access control system is installed in every apartment

- Italian flooring in flats

- European style kitchen

- Jogging track on the roof

- Separate yoga studio

- Sauna and pool

- Wifi facility

- All-time Power back is available

- Parking space for residents

8. M3M Natura - Residential Projects in Sector 68, Gurgaon

M3M India is an experienced yet knowledgeable construction company. They know what to bring to modern tricity families. With this in mind, they present a megaproject the M3M Natura. It is a purely residential project situated in the heart of Sector 68, Sohna Road, Gurgaon.

M3M Natura offers standard-sized well-crafted 2BHK and 3BHK apartments and flats. The total land area covered by this project is 13.21 acres. Whereas, the average size of an apartment is ranging between 1192 sq. ft. to 1478 sq. ft. Total 9 residential towers are introduced in this complex with each 21 floors high.

Additionally, all apartments in this project are brilliantly designed and planned to give a sense of comfort and peace to inhabitants. The apartments are installed with modern gadgets to provide a safe and secure living. M3M Natura has an abundance of greenery all over the premises which makes the scene even more delightful.

M3M Natura presents:

- Easy payment plan

- 2bhk and 3bhk luxury flats

- 240 units available

- Beautiful landscape coupled with Lush green gardens

- Fire control system and power backup system

- Comes with a lake within premises

- High-speed lifts

- Local connectivity

- The facility of spa and gym

- Also, a Pool deck

- Party hall and Clubhouse

- Jogging and cycling track too

- Ample of parking space

9. M3M One Key Resiments - Studio Apartments in Sector 67, Gurgaon

Again, M3M One Key Resiments is another modern marvel presented by M3M India. This project is a part of M3M Urbana and primarily focuses on 2BHK apartments and 1BHK studio apartments for sale. M3M One Key Resiments is located in sector 67, Sohna Road Gurgaon.

M3M One Key Resiments is spread across 8.2 acres of land and has a total of 150 units of 2BHK apartments and 1BHK studio apartments for sale. The general size of these apartments varies from 536 sq. ft. to 1050 sq. ft. there is ample space provided to residents in apartments so they can décor it according to their own need and choice.

Prominent shopping malls, movie theatres, schools, hospitals, banks as well as Business Park for job opportunities, all are available at near to M3M One Key Resiments. This project has potential to change the look of whole sector 67 in near future and also the life of investors as well.

Amenities of M3M One Key Resiments:

- Ready to move project

- Connected to all chief locations of the city

- Facility of Banks and ATM

- Lifts

- Swimming pool

- Jogging track

- Badminton and lawn tennis court

- Vehicle parking space

- Club house

- Security by guards and CCTV

- Rain water harvesting

- 24 x 7 power

10. M3M Urbana Premium - New Launch in Sector 67, Gurgaon

M3M Urbana Premium is a new upcoming project of M3M group. This project the M3M Urbana Premium is a next-level version of M3M Urbana as well as provides seamless connectivity to it. This is a commercial project that offers a wide range of office spaces and commercial retail spaces. Although M3M has many projects in Gurgaon, this art of work speaks for itself.

M3M Urbana Premium is proudly located on Southern Peripheral Road, Sector 67, Gurgaon. The total land bank covered by this project is 2.91 acres. Whereas the total salable area is ranging between 200 sq. ft. to 2000 sq. ft. available in different sections of 12 floors high M3M Urbana Premium.

Also, M3M Urbana Premium has a very clean and well-designed architecture. In fact, every essential element is sharply noticed and well placed. Also, in the future, M3M Urbana Premium is expected to be the most demanded shopping destination in Gurgaon.

Highlights:

- Earn 10% assured rental income

- M3M Merlin, M3M Golf Estate is in neighboring

- 100% backup of power backup

- Escalators and Lifts

- Exotic view

- Centralized AC installed

- Retail shops at first 2 floors

- Food court and fine dining

- Hypermarket and Multiplex available

- Third floor onwards are office spaces

- 3 side road connectivity

- Close connectivity to south Delhi

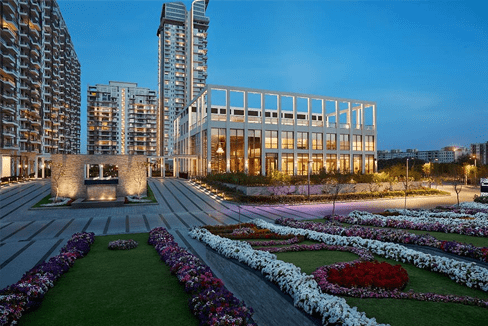

11. M3M Golf Estate - Buy home in Sector 65, Gurgaon

M3M Golf Estate is a surprisingly beautiful residential development of M3M Gurgaon. The project is ready to move in and available in sector 65, Golf Course Extension Road Gurgaon. M3M Golf Estate is a one-of-a-kind project that offers luxury homes in Gurgaon and also adds a statement to your living standards

Furthermore, the land area covered by this project is around 56 acres which makes M3M Golf Estate a grand and one of the most expanded residential projects in Gurgaon and Delhi NCR. There are 25 such luxury towers available in the whole M3M Golf Estate Complex. Each tower has 40 floors. Total 870 beautiful homes are waiting for you.

At the same time, the apartments are in standard 3bhk and 4bhk configurations, and the size of apartments varies between 300 sq. ft. to 6450 sq. ft. All apartments are installed with imported marble flooring and a modular kitchen. There is greenery, a joyful environment, vibrant views, and many more to explore.

Features of M3M Golf Estate:

- 3bhk and 4bhk apartments

- A mix of high and low rise towers

- Intercom facility

- Designer homes

- Swimming pool and spa

- Many indoor games activities

- Child care facility

- Rock climbing

- Golf course, badminton court, and basketball court

- High-speed elevators

- Power backup

- Lush green lawn

- Jogging track

- Rainwater harvesting

- Basement Parking

12. M3M Tee Point

M3M is continuously delivering one after other excellent projects in Gurgaon and changed the real estate phase of this rapidly growing city. They understand the need of modern workforces and retailers and develop projects accordingly. M3M Tee Point is a commercial project developed in sector 65, golf course extension road Gurgaon.

Talking about the land area of M3M Tee Point, the project is spanned over 2 acres of land. Tee Point available in 2 towers each with G+10 height. Further, these two blocks are separated by a 24-meter wide road. The retail section is available on the first two floors with a normal size ranging between 300 sq. ft. to 2800 sq. ft. On the other hand, the office spaces are available third floor onwards in 400 sq. ft. to 1930 sq. ft. size.

Uniquely developed M3M Tee Point offers office space, F&B hub, and commercial retail shops for sale. It is surrounded by many residential societies. Hence, a great chance to make an investment that brings fruit in the future.

Interesting features of M3M Tee Point:

- 10% assured rental return property before and after possession

- Affordable project of Gurgaon

- F&B Hub

- Luxury high street shopping complex

- Lots of leisure activities

- Modern work offices

- Dedicated pick and drop points of retail and office hub

- Beautiful lobbies and waiting area

- Multilevel basement parking

- Escalators and elevators

- Excellent connectivity to all major point of the city

- Traffic-free drive from the international airport

- Immediate power backup

- Security measures are property taken to provide a safe environment

13. M3M Prive 73 - Commercial space in Sector 73, Gurgaon

M3M Prive 73 is another exceptional construction of M3M India Pvt. Ltd. M3M Prive 73, not only describes the new meaning of commercial projects in Gurgaon but also define a new set of benchmarks for other constructions to meet. Â This grand project has raised the standard of the mall and retail market.

The project is located near highly populated residential societies and work office hub of sector 73, Southern Peripheral Road, Gurgaon. M3M Prive 73 is a purely retail and F&B hub along with multiples. The project is sprawling across 1.65 acres of land. 294 units are available for sale in this property with 200 sq. ft. to 2000 sq. ft. area.

Project features:

- Assured return per year

- An affordable project as investment starts with 50 lacs onwards

- Huge frontage

- Retail section with many national and international brands

- Promise maximum exposure to all stores

- Truly a family outing place

- Restaurants and café with indoor and outdoor seating facility

- 10 multiplex screens

- Fire safety

- Full power backup

- Ample of multilevel car parking

- Security measures are property taken

- A safe and vibrant environment

- High-speed lifts and escalators

14. M3M Ikonic - Buy flats in Sector 68, Gurgaon

M3M Ikonic at M3M Marina is a brand new residential project of M3M India Pvt Ltd. This ultra-luxurious project is located in the heart of sector 68 Gurgaon, further which connects the Golf Course Extension Road with Sohna Road, Gurgaon. It is important to realize that this area is posh and highly demanded among business ventures.Â

Together with this, the M3M Ikonic stretched across 13.21 acres of land that offers comfortable residential apartments and flats equipped with all modern facilities for a peaceful living. The property is available in two different variants i.e. 2 BHK flats of 1304 sq. ft. are available in 1.11 cr whereas 3 BHK flats of 1594 sq. ft. costs around 1.35 cr.

Also, the architectural design M3M Ikonic is so beautiful that it amazes you at every step when you walked through the grand lobby. M3M Ikonic by M3M Marina tries to fulfill their customers' expectations by understanding their needs.

Amenities of M3M Iknoic:

- It has as 1 tower of 29 floors

- Total 312 unit accommodation

- Beautiful view of Aravalli mountains

- Clubhouse, Cafe and party hall

- Sauna and spa

- Lush Green Parks

- Moreover, Sports facilities like Gym, Swimming pool, badminton and basketball courts, etc.

- Separate area for Yoga activities

- Separate Cycling track and jogging tracks

- Play/ activity area for kids

- Special security for a safe and secure environment

- High-Speed Lifts

- Boom barriers

- Lastly, the Intercom facility

Apart from the above, there are many other M3M projects in available Gurgaon. But these are the most lucrative ones from the investment perspective. Keep in mind to check other M3M properties and decide the one which suits you better as an investment vehicle.

Book a free site visit for your favorite project at Geetanjali Homestate Pvt. Ltd. or call at +91-9090906776