Will Budget 2025-26 Reduce Property Taxes & Home Loan Interest?

- By Admin

- Budget & Policy

- 02/02/2025

The Indian real estate sector has been a key driver of economic growth, evolving through various policy reforms and market trends. From addressing housing shortages post-independence to experiencing a boom post-liberalization, the industry has constantly adapted. As the Union Budget 2025-26 approaches, homebuyers, investors, and real estate consultants are eager to see what policy changes and financial reforms will shape the future of commercial property in Delhi NCR, Gurgaon and beyond.

Why Real Estate is the Best Investment Option in India 2025

Real estate remains a secure and profitable investment in India, driven by economic growth, urbanization, and rising incomes. Whether in commercial hubs like Delhi NCR or residential markets, here’s why property investment stands out:

- Tangible Asset with Appreciation – Unlike volatile stocks, real estate holds intrinsic value and appreciates over time, ensuring long-term gains.

- Stable Rental Income – Investing in commercial property in Gurgaon or metro cities offers steady rental returns due to high demand for office spaces and retail outlets.

- Inflation-Proof Investment – Property values and rental income rise with inflation, protecting investors from value erosion.

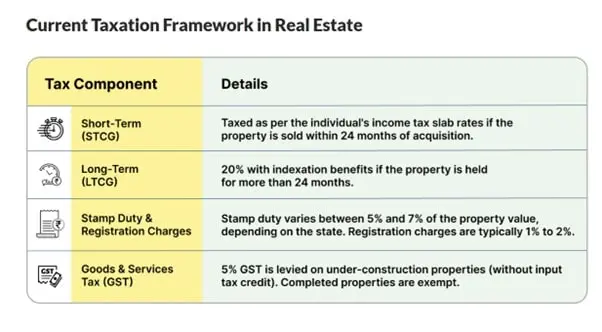

- Government Incentives & Tax Benefits

- Rising Demand & Urbanization – With India’s urban population set to hit 600 million by 2030, housing and commercial property demand is soaring. Government initiatives like Smart Cities Mission further boost growth, making Delhi NCR a prime investment hub.

- Portfolio Diversification & Stability – Unlike volatile stocks, real estate offers stability and retains value even during economic downturns.

- Emerging Investment Avenues – High-growth sectors include:

- Co-living & Co-working – Catering to young professionals and startups.

- Warehousing & Logistics – Fueled by the e-commerce boom.

- Luxury & Vacation Homes – Rising demand for premium properties.